The tax season can be a daunting time for many individuals and business owners. With ever-changing tax codes and laws, the temptation to tackle tax preparations alone can lead to costly mistakes. While DIY tax methods may appear tempting for cutting costs, the reality is that hiring a tax advisor can lead to significant financial benefits and peace of mind. Understanding when to know to seek expert help is important for anyone seeking to maximize their tax effectiveness and navigate the nuances of tax planning.

Whether you are self-employed, managing a small business, or just looking to ways to improve your personal finances, the insights of a professional tax advisor are priceless. They can help you navigate compliance issues, tax deductions, and even strategic planning for your future. In this article, we'll explore the reasons why investing in a tax advisor may likely save you a significant amount, as well as how to choose the right one to fit your specific needs. From steering clear of frequent tax mistakes to managing complex inheritance or capital gains taxes, we will reveal the numerous benefits of partnering with a qualified tax professional.

Top Benefits of Hiring a Tax Adviser

One of the main pros of engaging a tax adviser is the possibility for considerable economic benefits. A lot of individuals and businesses are unaware of the countless deductions and credits that they might gain access to, and a skilled tax adviser can help identify these possibilities. By enhancing your deductions, a tax adviser not only cuts your tax liability but can also enable you retain more of your hard-earned money. This informed approach can yield thousands of dollars saved each tax season.

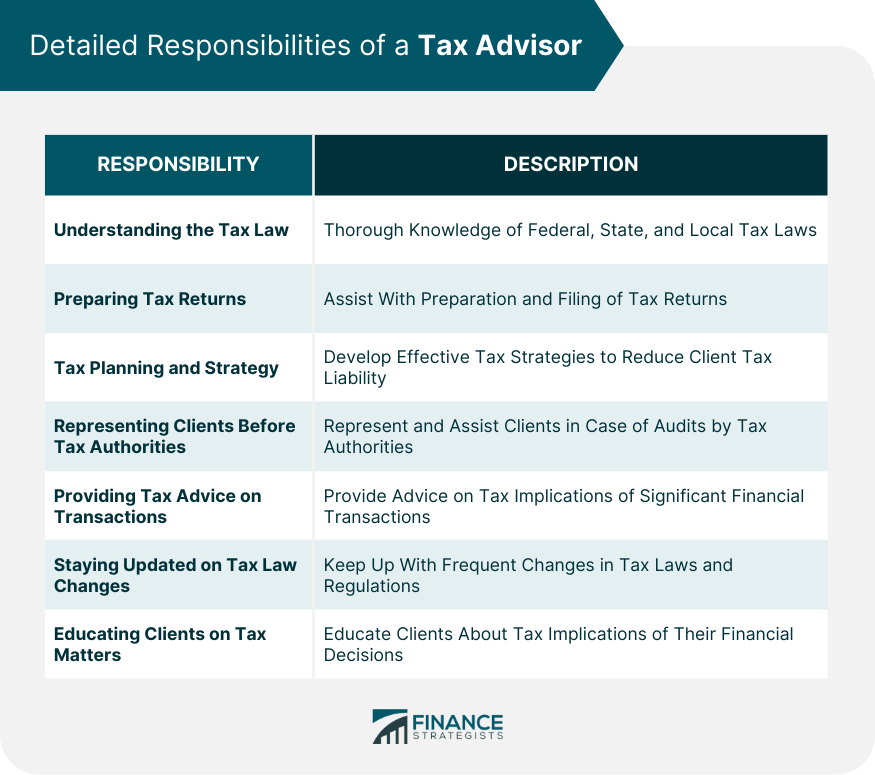

In addition to economic savings, tax advisers play a critical role in ensuring compliance with tax laws and regulations. The tax legislation is often complex and ever-changing, making it simple for taxpayers to make costly mistakes. A experienced tax adviser stays up-to-date with the newest tax legislation and helps clients navigate through these intricacies, reducing the risk of sanctions or audits. This reassurance allows clients to focus on their personal or business goals rather than concerned with potential tax complications.

Furthermore, hiring a tax adviser encourages a preventive approach to tax planning. Rather then only reacting to tax obligations at year-end, tax advisers can formulate a customized plan specific to your specific needs. This forward-looking strategy optimizes tax efficiency throughout the year, ensuring that unexpected financial burdens do not emerge at tax time. By collaborating with a tax adviser, individuals and businesses can build a healthier financial future built on sound tax principles and smart planning.

Common Tax Errors to Avoid

A very common mistake taxpayers make during tax season is missing deductions and credits they qualify for. Many taxpayers are unaware of the various tax benefits available to them, leading to missed opportunities for significant savings. A experienced tax adviser can assist find these deductions, whether they stem from educational expenses, medical bills, or remote work expenses, ensuring that clients fully utilize what the tax code allows.

Another common error is neglecting to keep precise records year-round. This neglect can lead to chaos and even rejections or audits from the IRS. Check out here emphasize the importance of careful record-keeping, which not only simplifies the filing process but also creates a strong basis for any deductions claimed. By developing a methodical approach to documentation, advisers assist clients achieve organization and tranquility.

Lastly, many people make mistakes regarding their filing status or incorrectly categorizing their income, especially self-employed individuals. Choosing the wrong filing status can lead to greater tax burdens or missed opportunities for tax breaks. Tax advisers guide clients through these choices, ensuring they select the most beneficial status while accurately reporting all income. Their expertise in tax laws avoids costly errors and ensures compliance with regulations.

Deciding the Appropriate Tax Adviser

Choosing the appropriate tax consultant is essential for improving your monetary situation and ensuring compliance with tax rules. Commence by reviewing the qualifications and expertise of prospective advisers. Find someone with applicable qualifications, such as a CPA, and ask about their experience in handling cases like to your situation. It's also advantageous to request recommendations from reliable sources or look at testimonials to evaluate their standing and effectiveness.

After you have selected a few options, set up first consultations to talk about your specific needs. This is an opportunity to assess their way of communicating and readiness to understand. A good tax adviser should clarify complex tax matters in a straightforward manner and provide tailored advice based on your individual circumstances. Additionally, learn about their approach to tax strategy and how they stay updated with updates in tax legislation, which can significantly affect your monetary position.

Consider the cost of the help offered, but remember that the cheapest option is not always the best one. Evaluate the value that each adviser offers, including their methods for maximizing deductions and reducing liabilities. In the end, select a tax adviser who not only matches your cost expectations but also fosters a feeling of trust and confidence in their ability to manage your tax-related matters effectively.